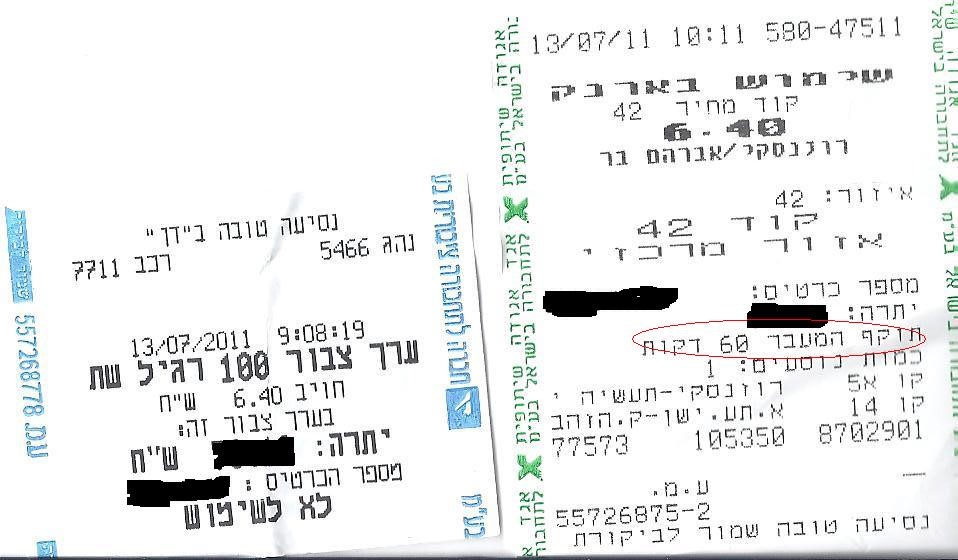

Recently one of our guests was on her way to toss her used bus ticket into the garbage can when Yosef, my pre-teen son, politely suggested that she keep her receipts. “Why?” she asked. “So this way you’ll know how much you spend on the important things and you’ll know how much you have left to spend on the fun things,” he answered. “But a bus ticket?” she asked. “Even a bus ticket, since every shekel matters,” was his response.

It seems as if my son has mastered the basics of budgeting. He realizes that knowing where you spend can help you create a realistic budget. But keeping receipts isn’t enough. Yosef should have further counseled our guest that she should analyze spending habits on a regular basis. The best way to create a budget is to track all expenses (even bus tickets and ice cream receipts!) for a few months, and then determine if this is a reasonable rationing of your resources. If your current spending habits don’t let you save even a small amount on a regular basis, it’s time to re-evaluate your spending lifestyle.

Keep your receipts, but not stuffed into a drawer. Enter them into a system that works for you (a computer program or a simple notebook), and evaluate your spending habits. I once spoke with a young woman who was apartment hunting, anxious to live on her own. She asked me what a reasonable rent was. I told her that the shekel amount wasn’t as important as the percentage of her total income. From the shocked look on her face, I could tell she never realized how her various expenses related to each other. I suggested that she anticipate her fixed and discretionary expenses and see if she could design a budget that included living in her dream apartment … otherwise moving in with roommates might be the best fiscal option.

Knowledge of your resources and how you spend them is the first step to fiscal success. The Egged bus ticket might not only get you to work, but may lead you to the path of financial security.

Douglas Goldstein, CFP®, is the Director of Profile Investment Service, Ltd., which specializes in helping people who live in Israel with their US dollar assets and American investment and retirement accounts. He helps olim meet their financial goals through asset allocation, financial planning, and using money managers.

Published May 20, 2012.